In 1966, General DE GAULLE called for the construction of a plant in the north of New Caledonia in order to rebalance or adjusting the socio-economic situation between the North and the South.

This wish was fulfilled thanks to the mobilisation of the population of the North, the institutions and the support of a quality industrial partner, the Canadian company Falconbridge, then the second largest nickel producer in the Western world.

In 1998, the signing of the Bercy Agreement enabled SMSP to exchange the Poum Mining Deposit, which it owned at the time, for SLN’s Koniambo massif, both located in the Northern Province, subject to suspensive conditions.

During the initial phase of the metallurgical project, SMSP brought the Koniambo Deposit and the advantages of its local presence. Falconbridge (absorbed in 2006 by Xstrata PLC, which merged with Glencore in 2013) provides the feasibility studies and all the financing, and guarantees that the work will be carried out properly and ramped up.

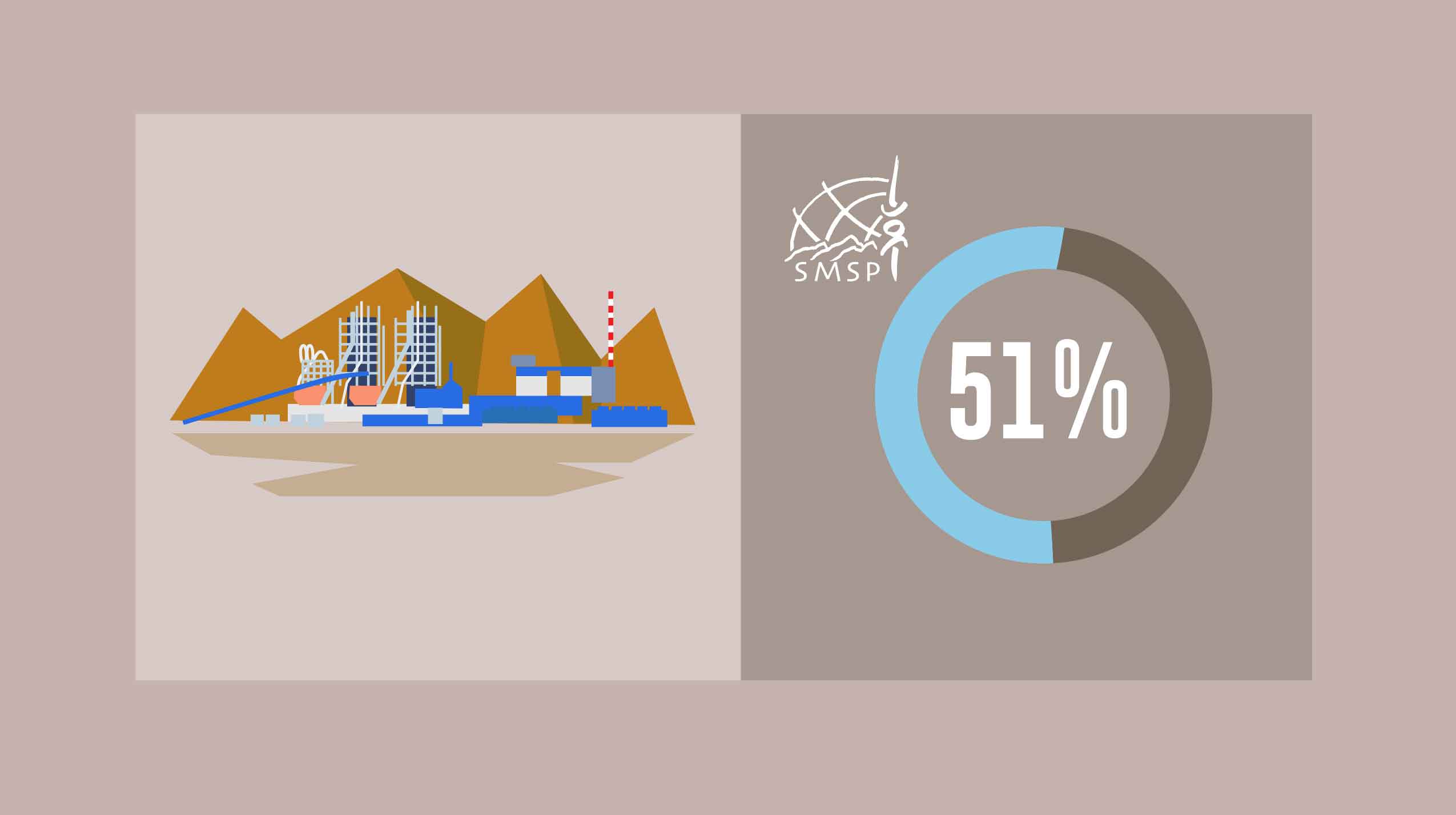

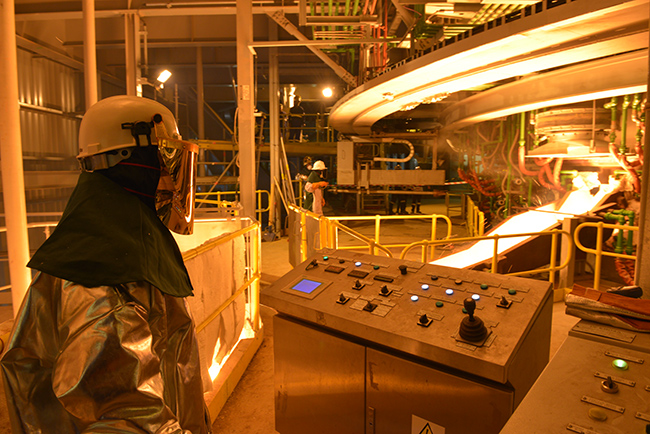

A joint venture, KNS SAS, has been set up to manage the construction and operation of the plant, which will convert ore into ferronickel with a nominal capacity of 60,000 tonnes per year. The Plant Equity’s 51% is owned by SMSP and 49% by Glencore, the Swiss Commodities Trading Giant.

Glencore is financing the entire cost of building the metallurgical plant. Repayment of the loans granted by Glencore is therefore the direct responsibility of KNS. As a result, neither SMSP nor the North Province have had to take any unreasonable financial risks in this project. In addition, the two KNS shareholders are bound by a non-dilution clause. SMSP’s 51% stake in the Northern Plant is guaranteed regardless of construction costs, with no risk to the local community and authorities.

Faced with market difficulties and KNS’s high operating costs, Glencore finally announced in September 2023 its decision to stop financing KNS’s operations by February 2024, and to put the site on standby for at least 6 months.

The SMSP is wearing contact with the parties involved, Glencore, Koniambo Nickel and the French government, represented in particular by CIRI (Inter-ministerial Committee for Industrial Restructuring). Solutions were sought to avoid Glencore’s departure. Despite numerous meetings well before Glencore’s announcement, the latter’s departure seems inevitable.

Nevertheless, SMSP and KNS managed to negotiate the retention of all employees for a period of 6 months. Glencore provided the funding for this measure. The French Government was approached, but submitted conditions for financial support that Glencore did not consider reasonable.

On 29 February, as announced by Glencore, the Koniambo Nickel site was worn in hot standby, but the payroll was maintained. All subcontractor contracts were suspended. At the end of the validated 6-months period, the site was put on cold standby, and almost all the workforce was made redundant for economic reasons, i.e. almost 1,000 people. A minimum team of 100 people will remain on site to place the facilities on cold standby and monitor the structures and equipment.

At the same time, a process to sell Glencore’s stake in KNS began on 29 February. The outgoing shareholder, Glencore, selected an investment bank to lead and manage the process. SMSP and Koniambo Nickel are closely associated.

The process is divided into several phases, the first of which is the communication of a project presentation to a panel of interested groups. This first phase was completed on 15 July 2024. Three groups expressed an interest and submitted a non-binding offer.

Since 2020, economic conditions have been wearing on the joint ventures. Health problems linked to Covid-19, followed by a major rainy season in New Caledonia, gradually affected the annual supply volume of the SNNC plant. In South Korea, the devastating effects of super typhoon Hinnamnor in September 2022 led to the shutdown of the Pohang furnaces, making it extremely difficult for SNNC to sell its finished product. Lastly, these events occurred at a time when the nickel market is increasingly competitive and energy costs are rising, thereby increasing operating costs.

In order to sustain SNNC’s competitiveness, SMSP and POSCO signed an agreement in 2021 to diversify the Gwangyang plant’s production towards matte. SNNC then began its entry into the market for batteries of electric vehicles.

To date, two of the groups have submitted sufficiently convincing bids, and they are continuing to take steps, including visits to the Koniambo Nickel site.

SMSP’s priority is to negotiate and convince a buyer in order to ensure the continuity of production and jobs.

SMSP and Falconbridge commit to a partnership project.

Signing of the Bercy Agreement between the French State, the Territory of New Caledonia, ERAMET, SLN and SMSP in the presence of the French Development Agency (AFD).

Start of deployment of the Koniambo Industrial Project. The deposit is worn by the joint venture to assess the Koniambo Massif potential nickel resources in accordance with the framework set by the Bercy Agreement.

Irrevocable Decision to build the plant with exchange of the Poum and Koniambo Massifs under the terms of the Bercy Agreement. Establishment of Koniambo Nickel SAS (KNS).

Ceremony to lay the 1st stone in the presence of François BAROIN, then French Minister for Overseas.

Xstrata Nickel becomes SMSP’s new partner in the Koniambo Project, following the takeover of Falconbridge.

Launching of preparatory works: site access and supply of services (water supply, power, etc.), construction of offices, phase 1 of the life Support Base.

Xstrata Plc approves the launch of construction work on the Northern Plant, for an investment of USD 3.8 billion.

Signing of the Project Agreement between the Government of New Caledonia, the North Province, KNS, SMSP and Xstrata.

Granting of tax approval by the French Authorities under the French Overseas investment tax incentive scheme (known as the ‘Girardin Law’).

Arrival of the first building blocks modules manufactured in China at Vavouto.

Nicolas SARKOZY, French President of the Republic’s visit.

Merger between Glencore Plc and Xstrata PLC.

First casting of metal from the second production line..

François HOLLANDE, the French President of the Republic’s visit, and official inauguration of the Northern Plant.

Glencore announces that it will cease financing Koniambo Nickel’s operations.

Suspension of operational activities. The plant’s facilities are put on warm standby.

Launching of the process to buy Glencore’s shares in Koniambo Nickel. Selection of an investment bank.

Operations ceased. Facilities put on cold standby.