Ouaco is the historical heart of Société Minière du Sud Pacifique (SMSP). It was once owned by the LAFLEUR family, who operated a nearby mining site belonging to the SLN under a lease agreement that lasted until 2000. The village of Ouaco was established in the early 1900s around a beef cannery built by Société d’Élevage de Ouaco, which managed New Caledonia’s largest cattle herd across a vast estate spanning several thousand hectares.

After acquiring Société de Ouaco, Henri LAFLEUR ventured into the mining industry, first on the Ouazanghou massifs and later on the Taom massif in 1969, operating concessions owned by SLN. Most of the families settled in the village who had been working in livestock remained there, adapting to the site’s new purpose. It was here that SMSP was formed in 1969 when the LAFLEUR family sought to bring in new shareholders. In 1990, following the signing of the Matignon Accords, the company—along with the entire village—was purchased by SOFINOR, and it continued its extraction activities for both SLN and international export clients.

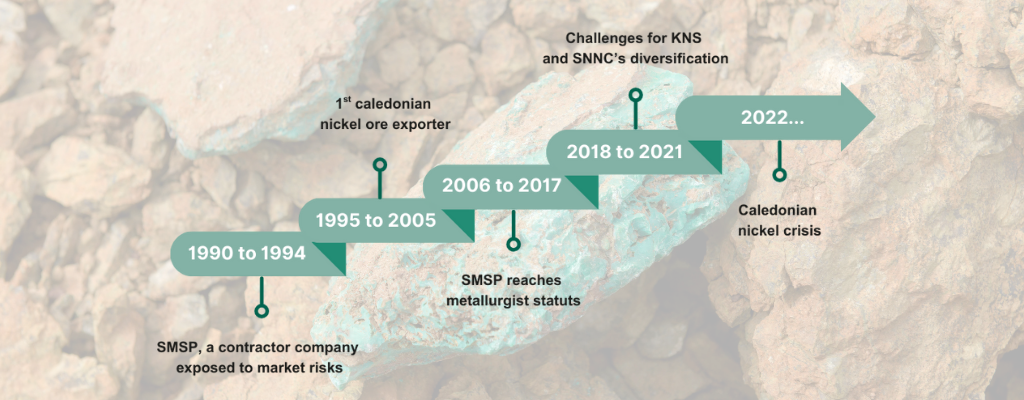

Société Minière du Sud Pacifique: A Contract Miner Exposed to Market Risks

The Société Minière du Sud Pacifique (SMSP), founded by the Lafleur family, was established in Ouaco in 1969. At the time, it operated a mining domain belonging to the Société Le Nickel (SLN) under a lease agreement that remained in effect until 2000. When SOFINOR acquired 85% of its capital, SMSP was essentially a “contract miner” (tâcheron) with no mining assets of its own. Its activity consisted of operating deposits owned by the SLN in exchange for royalty payments.

At that time, SMSP had no direct commercial sales channels; it was dependent on traders and local exporting companies, to whom it paid commissions. While profitable during “boom” periods, the company was at risk of bankruptcy as soon as nickel prices suffered a sustained drop. Nevertheless, in 1990, SMSP generated a turnover of 1.2 billion XPF by exporting 309,000 tonnes of ore and employing 120 people. At that point, it only held three years’ worth of mining reserves for its deliveries to SLN and for export.

• 1990 and 1994: The Collapse of Nickel Prices

The early 1990s were marked by a fall in global nickel prices on the London Metal Exchange (LME), dropping from an average of $4 USD per pound in 1990 to $2.4 USD per pound in 1994. The depreciation of the US dollar, combined with the drop in selling prices, hit the New Caledonian market hard, forcing it to sell at a loss.

• Securing Direct Commercial Contracts: Ending Commissions

The new priority was to negotiate new commercial contracts and limit the commissions paid to middle-men. As early as 1991, SMSP established new direct export agreements with smelters, allowing it to eliminate these commissions.

• Building a Mining Heritage

SMSP’s other strategy was to build its own mining portfolio to ensure the long-term sustainability of its operations and commercial agreements. An extensive prospecting program was launched, securing 20 million tonnes of exploitable reserves. To safeguard its resources, SMSP also made the decision to stop selling its high-grade ore.

The Leading Exporter of New Caledonian Ore

By the end of 1994, nickel prices on the LME rebounded due to an increase in demand. SMSP possessed sufficient reserves and the technical capacity to meet this demand. It doubled its export volume between 1994 and 1995, surpassing the milestone of 2 million tonnes exported.

As a result, New Caledonian nickel regained 50% of the Japanese market share and 66% of the Australian laterite market. At that time, SMSP was exporting the equivalent of 40,000 tonnes of nickel metal and 750 tonnes of cobalt per year.

By the end of 1995, the company had increased its export levels sevenfold compared to 1990. It then became the leading ore exporter in New Caledonia. Its export volume ranked the company second in the world for the production of oxidized ores. Its activity generated approximately 1,000 direct and indirect jobs.

• Transformation and Search for Industrial Partnerships

Mining alone was not enough to ensure the economic takeoff of the region or to encourage populations to settle in the Northern Province of New Caledonia. With its scattered sites, mining extraction by itself could not generate the urban economic dynamic required for the North Province.

SMSP had to aim for smelter status. In 1994, it began seeking partnerships with metallurgical companies to gain access to the technology and financing necessary to become a metal producer.

• A Major Partner

The Canadian giant Falconbridge, the world’s third-largest metallurgical company at the time, expressed interest in forming a joint venture with SMSP. The partnership was formalized in April 1998 by André Dang Van Nha and Oyvind Hushovd. The company Koniambo Nickel SAS (KNS) was created.

SMSP held 51% of the capital in the KNS joint venture. It contributed the Koniambo deposit, its professional expertise, and its local presence. Its partner held 49% of the capital, provided the feasibility studies, and acted as a guarantor for the project’s financing and the successful completion of construction.

SMSP integrated the acquisition of majority stakes in mining and metallurgical assets into its core strategy.

SMSP Becomes a Dual Metallurgical Producer

This decade is defined by the finalization of two partnerships and the launch of construction for two metallurgical plants. This decisive period marks SMSP’s entry into the exclusive field of metallurgy.

• The Northern Plant Rises from the Ground

In August 2006, Xstrata Nickel became the new partner for the Koniambo project following its acquisition of Falconbridge. Agreements were signed to revise costs, which rose to 5 billion USD in 2011. For its part, the French State granted a tax approval (the Girardin Law), which enabled the financing of the power plant.

In May 2013, following the merger of Glencore PLC and Xstrata, Glencore PLC became SMSP’s new partner. In August 2014, a further cost increase was announced, bringing the project total to 7 billion USD.

Initial construction began in March 2007, notably with the dredging of the Vavouto channel in 2008. Construction of the first production line was completed in December 2012, and KNS celebrated its first metal tapping in April 2013. In 2014, the second production line was completed, and the Northern Plant was inaugurated on November 17, 2014, by François Hollande, President of the French Republic.

At the peak of the construction phase, approximately 5,400 workers of over fifty different nationalities worked on the site. In its operational phase, KNS created 907 direct jobs, 450 indirect jobs (on-site subcontractors), and approximately 2,500 induced jobs. 80% of the Northern Plant’s employees are Caledonians.

• Confirmation of the Shareholding Model

In 2006, a Memorandum of Agreement (MOA) was concluded between SMSP and the Korean stainless steel giant POSCO to create two joint ventures: NMC (Nickel Mining Company) and SNNC (Société du Nickel de Nouvelle-Calédonie et Corée). NMC is responsible for ore extraction, which feeds the SNNC plant located in Gwangyang, South Korea. SMSP’s mining titles were transferred to NMC. SMSP became a 51% shareholder in both companies, while POSCO holds 49% of the shares in each.

The SNNC metallurgical plant was built between June 2006 and October 2008 at a cost of 352 million USD. Its start of production on October 20, 2008, marked SMSP’s official entry into the metallurgical sector. SNNC was officially inaugurated on November 3, 2008, and reached its nominal capacity in October 2009. Three years after production began, in August 2011, POSCO and SMSP decided to proceed with a second production line, which was inaugurated on March 6, 2015. These new facilities allowed SNNC to increase its annual production capacity from 30,000 to 54,000 tonnes of ferronickel.

• An Aborted Partnership

SMSP continued its search for partnerships based on its shareholding model. In February 2012, discussions took place with the head of the Jinchuan Group, Yang Zhiqiang. SMSP sought to add value to Caledonian lateritic ore. However, the discussions were inconclusive, and SMSP decided not to risk its resources in a partnership for which it could not secure sufficient supply—as lateritic resources are predominantly located in the South Province.

Challenges for KNS and SNNC Diversification

• KNS Fails to Reach Nominal Capacity: Technical Issues and COVID-19

At the time of its inauguration in November 2014, KNS plant had a nominal production capacity set at 60,000 tonnes of nickel per year. However, by the end of that same year, the plant encountered major technical setbacks. A metal leak, caused by a gap between the refractory bricks and the tapping block, necessitated repairs on both production lines. This failure led to a downward revision of production capacity, which was adjusted to 54,000 tonnes per year.

In 2018, technical upgrades allowed for a slight recovery, with production reaching 28,300 tonnes—a 62% increase over the previous year. However, in 2020, the COVID-19 pandemic severely disrupted operations. Production plummeted by 29%, falling to 16,900 tonnes.

In 2021, KNS faced further technical difficulties, including breakdowns at the power plant and in one of the two production furnaces. These issues prevented the plant from meeting its targets, limiting production to 17,000 tonnes of ferronickel. Nevertheless, starting from the last quarter of 2021, the situation gradually improved. The recommissioning of the second furnace enabled a recovery in ferronickel production.

• SNNC Shifts Toward Matte Production

Since 2020, SNNC has faced major challenges, including the COVID-19 pandemic, extreme weather events, and a more competitive nickel market—driven particularly by the rise of Nickel Pig Iron (NPI) and soaring energy costs. In 2021, SNNC diversified its production to target the electric vehicle battery market, with long-term goals of producing 26,000 tonnes of ferronickel and 21,000 tonnes of nickel matte.

This strategic shift allows the plant to remain competitive while contributing to the reduction of CO2 emissions. Over 13 years, SNNC has produced 430,000 tonnes of nickel metal and paid 11 billion XPF in dividends to SMSP.

• SMSP: Searching for New Partners

On March 22, 2021, SMSP Group and the Chinese company Yangzhou Yichuan Nickel Industry Co Ltd signed a Memorandum of Agreement (MOA) outlining the main pillars of a partnership project. The plan was based on SMSP acquiring a 51% majority stake in a pyrometallurgical plant located in China to process low-grade ore.

Following a strategic shift by its partner, SMSP made the decision to terminate these discussions in February 2023.

New Caledonian Nickel Crisis: Glencore Funding Withdrawal, KNS Care and Maintenance, and Civil Unrest

• Glencore Announces Cessation of KNS Funding

On September 27, 2023, the Swiss group Glencore announced that it would stop funding Koniambo Nickel (KNS) plant as of February 29, 2024.

As a major shareholder in KNS, Glencore justified its decision by citing structural financial problems and an uncertain economic environment, exacerbated by falling nickel prices and rising energy costs.

• Warm Standby and Subsequent Transition to Cold Standby at KNS

February 29, 2024, marked the suspension of “hot” operations at KNS for a six-month period, during which the workforce was initially retained. However, contracts for the majority of subcontractors were terminated. During this period, maintenance and reorganization work took place within the company to prepare for a potential restart of operations.

By August 31, 2024, in the absence of a buyer, approximately 1,200 employees were laid off and the site was placed on cold standby. Both furnaces were shut down—a catastrophic event for the site and the entire surrounding region.

Initially, only about 100 employees remained on KNS site, a number further reduced to approximately 60 by late December 2024. This skeleton crew is responsible for equipment security and maintenance throughout the duration of the cold standby phase.

The search for a new investor continues as part of Glencore share sale process, managed by an investment bank.

• Civil Unrest in New Caledonia

The riots that began on May 13, 2024, had a direct impact on the mining activities of NMC and, consequently, the entire SMSP Group. The mining centers of Kouaoua and Nakéty suffered significant damage and degradation.

In the second half of 2024, Ouaco, Poya, and Kouaoua centers successively resumed operations; however, the Nakéty site remains inaccessible. The reduction in NMC’s activity volume has also affected SNNC and Cotransmine. Short-time working (partial unemployment) arrangements were approved by unions for a portion of the workforce, particularly within support services at NMC Ducos and Cotransmine site at Numbo.